ifse cifc practice test

Canadian Investment Funds Course Exam

Question 1

Xian-Li believes she is a sophisticated investor. She has constructed her own portfolio and has had

some success. She does not believe in studying a company’s details such as earnings, expenses, or

assets. She is more concerned with patterns in a company’s stock price over time. She believes

patterns form and can be used to predict future movements in the market.

How does Xian-Li evaluate the companies in her portfolio?

- A. fundamental analysis

- B. flowchart analysis

- C. technical analysis

- D. value analysis

Answer:

C

Question 2

Yesterday, Mariana purchased mutual funds for the first time from Diablo, who is a Dealing

Representative for Horizon Financial. When Mariana mentions to her friend Marcus that she just

started to invest, Marcus confides that he experienced losses from mutual fund investing. Her initial

feelings of excitement have now changed to worry and regret. She wished she had talked to her

friend before investing and wonders if she can change her mind.

Which statement regarding the right of withdrawal applies?

- A. The right of withdrawal is based on the securities act legislation within the jurisdiction the purchase occurred.

- B. Before Mariana can cancel her order, she must wait two business days to pass before she can cancel her order.

- C. How the right of withdrawal can be applied is determined by the Mutual Fund Dealers Association of Canada's conduct rules.

- D. The Canadian Securities Administrators have instituted national instruments regarding Mariana's right to cancel her order.

Answer:

A

Question 3

Iliana owns 1,000 participating preferred shares in the First Canadian Bank. Which of the following

features are characteristic of her investment?

- A. Iliana has the right to purchase more preferred shares in the company before common shareholders.

- B. Iliana is able to vote at the annual general meeting and elect members of the board of directors.

- C. Iliana can convert her preferred shares to common shares at a fixed price and within a specified time period.

- D. Iliana has a right to share in the bank's net profits over and above the specified dividend rate.

Answer:

D

Question 4

Wilma has always used the services of a tax preparation firm to file her taxes but is skeptical that she

has really benefitted. This year she plans to file her own taxes for the first time.

What would be useful for her to know?

- A. Wilma's marginal tax rate may be lowered when tax deductions are applied to her total income.

- B. Wilma's top marginal tax rate will be applied to every taxable dollar when her tax return is filed.

- C. Wilma's tax deductions permit her to reduce her tax payable dollar-for-dollar.

- D. Wilma's non-refundable tax credits may only reduce her taxable income dollar-for-dollar.

Answer:

A

Question 5

One of your clients, Fernando, is approaching 71 years of age and has a few questions regarding life

income funds (LIFs).

Which of the following statements about LIFs is TRUE?

- A. Fernando may make contributions to his LIF if he continues working.

- B. Fernando is free to withdraw any amount from his LIF above the minimum amount.

- C. Fernando can transfer money from his registered retirement savings plan (RRSP) to a LIF.

- D. Fernando can transfer money from his locked-in retirement account (LIRA) to a LIF.

Answer:

D

Question 6

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal

registered retirement savings plan (RRSP) and knows there are rules about what she can do with

those funds. Which of the following is TRUE?

- A. She can convert her RRSP to a locked-in retirement income fund (LRIF).

- B. She can convert her RRSP to a registered retirement income fund (RRIF) this year or by December 31st of next year.

- C. She can take the entire amount in cash, with no tax consequences because her RRSP funds were tax-sheltered.

- D. She can purchase a registered term or life annuity.

Answer:

B

Question 7

With respect to the tax treatment of dividends received from a taxable Canadian corporation, which

of the following statements is CORRECT?

- A. Dividends are taxed the same way interest income is taxed.

- B. Dividends from both preferred and common shares of Canadian corporations receive preferential tax treatment.

- C. Dividends from non-resident corporations receive preferential tax treatment.

- D. Only 50% of dividend income is subject to tax.

Answer:

B

Question 8

What information does Fund Facts provide to potential investors?

- A. What the mutual fund is currently investing in.

- B. How to calculate the taxes owed from investment income.

- C. The portfolio management strategy that is used.

- D. The remuneration paid to the Independent Review Committee.

Answer:

A

Question 9

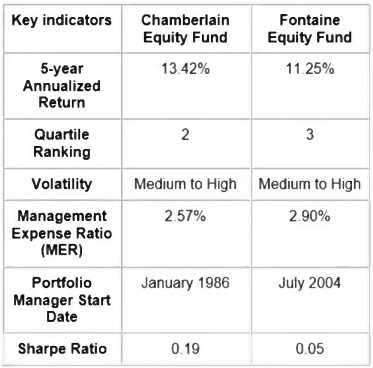

You have been researching Canadian equity mutual funds for a new client. You come across the

following information.

What can you conclude from this information?

- A. Chamberlain Equity Fund has lower volatility since its 5-year annualized return is higher.

- B. Fontaine Equity Fund is a better fund because it has a higher quartile ranking.

- C. Fontaine Equity Fund has a lower risk level since its Sharpe Ratio is lower.

- D. Fontaine Equity Fund's higher MER contributes to its lower 5-year annualized return.

Answer:

D

Question 10

Gershon is a Dealing Representative and he opens a new account for his client, Isaac. Gershon

collects the necessary information from Isaac in order to designate the Trusted Contact Person (TCP)

for Isaac’s account. Which of the following statements about Isaac’s TCP is CORRECT?

- A. The TCP is an alternative to a Power of Attorney (PQA) and has the authority to make changes to Isaac's account and direct trading.

- B. The TCP is an alternative authority on Isaac's account that has the power to place a temporary hold on Isaac's account to disallow trading.

- C. The TCP is the person whom Gershon can speak to if he becomes concerned about Isaac's mental capacity to make financial decisions.

- D. The TCP is the person who is designated with authority to direct financial dealings for Isaac's account and make financial decisions.

Answer:

C

Question 11

When you buy a put option, which of the following is TRUE?

- A. You have the right to sell a set number of shares at a set price.

- B. You have the right to purchase a set number of shares at a set price.

- C. You have the obligation to sell a set number of shares at a set price.

- D. You have the obligation to buy a set number of shares at a set price.

Answer:

A

Question 12

David had $10,000 in his investment account with Dynamic Investments, a mutual funds dealer. On

June 28, David wants to buy 500 units in ABC Canadian Dividend Fund that has a Net Asset Value Per

Unit (NAVPU) of $14.10. His friend Robert suggests that he may get a better price if he used the

strategy of dollar-cost averaging. David then instructs his Dealing Representative to place a purchase

order for 100 units on the first of every month starting July 1st for the next 5 months.

The orders are executed at the following NAVPUs.

July 01, $14.00

Aug. 01, $14.50

Sep. 01, $15.00

Oct. 01, $14.25

Nov. 01, $16.50

Did David get a better purchase price following the dollar-cost averaging strategy compared to

making a lump-sum purchase of 500 shares on Jun 28, 20xx?

- A. David got his 500 units at the same price as the lump sum price he would have paid.

- B. David got his 500 units at a lower price than the lump sum price he would have paid.

- C. David realizes that Dollar cost averaging is the best strategy for getting lower prices.

- D. David got his 500 units at a higher price than the lump sum price he would have paid

Answer:

D

Question 13

Your client, Helen, just received her non-registered account statement which states that one of her

mutual funds made an interest income distribution during the year. She asks you how she will be

taxed on the distribution. What do you tell Helen?

- A. She will pay taxes on 50% of the distribution.

- B. She will pay taxes at her top marginal tax rate.

- C. She will pay taxes on the grossed-up amount of the income.

- D. She will pay taxes at her average tax rate.

Answer:

B

Question 14

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC)

indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is

invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton

that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored

Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

- A. Quinton can proceed with the purchase of the Prospect Labour-Sponsored Fund because it is suitable for Banji based on her current KYC.

- B. Quinton should update Banji's risk profile to "high" so that he can proceed with the purchase of the Prospect Labour-Sponsored Fund.

- C. Quinton should not proceed with the purchase of the Prospect Labour-Sponsored Fund because it is not suitable for Banji based on her current KYC.

- D. Quinton must provide Banji with full disclosure about the risks so that he can proceed with the purchase of the Prospect Labour-Sponsored Fund.

Answer:

C

Question 15

What type of mutual fund can invest in specified derivatives and forward contracts for grains, meats,

metals, energy products, and coffee?

- A. global equity fund

- B. commodity pool

- C. labour-sponsored investment fund

- D. specialty fund

Answer:

B