cima cimapro19 p02 1 practice test

P2 Advanced Management Accounting

Question 1

An electronics company sells a range of tablet computers. Tablet computers come complete with an

operating system that is regarded as the market leader. The company aims to launch a new version of

its hardware every eighteen months and a major update to its software every three years. The latest

version of the tablet computer is always sold at a higher price, but the older version that has been

replaced is then sold for a time at a discounted price.

Which pricing model does this company appear to be using?

- A. Penetration and loss leader pricing

- B. Penetration and product bundling

- C. Skimming and loss leader pricing

- D. Skimming and product bundling

Answer:

D

Question 2

K Supermarket spends $80,000 per year on checking and processing receipts of inventory. Annual

warehouse costs are a further $70,000 per year. These costs are currently treated as fixed overheads

in the company's costing system.

As an experiment, the company is preparing a direct profitability analysis of a small range of

products, including fresh grapes.

K Supermarket receives a total of 3,600 deliveries every year. 20% of these deliveries are of

perishable goods such as grapes. It takes twice as long to process a delivery of perishable goods

compared to a normal delivery because perishable goods have to be checked more carefully.

Half of the warehouse costs are for the chilled store that is used to store perishable goods. At any

time, the chilled store has 800 kilos of perishable goods in stock.

K Supermarket receives 150 deliveries of grapes every year. Each delivery is for 100 kilos of grapes.

The grapes spend an average of two days in the chilled store before they are sold.

Calculate the total cost per kilo of checking, processing and storing grapes that should be taken into

account in determining the profitability of grapes.

Give your answer to the nearest whole cent.

Answer:

61 cents

Question 3

A company is classifying its quality costs to prepare a quality cost report. Which of the following are

conformance costs?

Select ALL that apply.

- A. Internal Failure Costs

- B. External Failure Costs

- C. Prevention Costs

- D. Appraisal Costs

Answer:

C, D

Question 4

Which of the following would change if the cost of capital of a proposed project was increased?

- A. Internal rate of return

- B. Payback period

- C. Accounting rate of return

- D. Net present value

Answer:

D

Question 5

Division A and Division B are divisions of the same group. Division A transfers all of its output to

Division B.

Which THREE of these alternative transfer pricing bases will prevent any cost inefficiencies in

Division A being passed on to Division B?

- A. Standard variable cost

- B. Actual full cost

- C. Actual prime cost

- D. Market price

- E. Actual variable cost

- F. Standard variable cost plus a profit margin

Answer:

A, D, F

Question 6

In accordance with a just-in-time (JIT) philosophy, which of the following is regarded as a value added

activity?

- A. Inspecting raw material deliveries

- B. Moving work in progress around production facilities

- C. Holding inventory

- D. Dispatching products to customers

Answer:

D

Question 7

When making an investment decision, which THREE of the following are reasons why receiving $1

today is preferable to receiving $1 in the future?

- A. Uncertainty

- B. Inflation

- C. Taxation

- D. Re-investment opportunities

- E. Depreciation

Answer:

A, B, D

Question 8

The money cost of capital is 12%. The expected rate of inflation is 4%. What is the real cost of capital?

Give your answer to 2 decimal places.

Answer:

7.69 %, 7.70

%

Question 9

Company X is considering the launch of a new product. In order to compete in the market the selling

price must be $100 per unit. Company X aims to achieve a sales margin of 25 per cent.

Direct materials cost is $75 for each unit. It takes 15 minutes for workers to assemble each unit.

Workers are paid $16 per hour. 5 per cent of paid time is idle. Overheads are absorbed at $6.50 per

unit.

What is the value of any cost gap between the forecast total cost and the target cost?

- A. $10.71

- B. $5.50

- C. $10.50

- D. $9.10

Answer:

A

Question 10

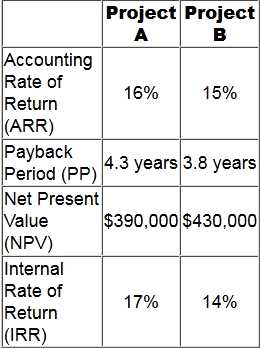

A company is considering two mutually exclusive projects, an analysis of which is given below:

The company's cost of capital is 12%.

Assuming an objective of maximising shareholders' wealth, which project would be

recommmended?

- A. Project B because it has the higher net present value.

- B. Project B because it has the shorter payback period.

- C. Project A because it has the higher accounting rate of return.

- D. Project A because it has the higher internal rate of return.

Answer:

A

Question 11

Residual income is an appropriate performance measure for which type of responsibility centre?

- A. Cost centre

- B. Revenue centre

- C. Investment centre

- D. Profit centre

Answer:

C

Question 12

Which TWO of the following are examples of management information made possible by the

availability of big data?

- A. Customer profitability analysis to identify key strategic customers

- B. Customer information harvested from social media to target products

- C. Production cycle time analysis to improve production efficiency

- D. Real-time inventory management information shared with producers to influence their production plans

- E. A five year history of a company's aged debtor list to assess the long-run effectiveness of credit control

Answer:

B, D

Question 13

A very large organization is financed by both debt and equity. It evaluates all projects on the basis of

their net present value (NPV) using an organization wide weighted average cost of capital as the

discount rate.

For a small project, which TWO of the following would affect the project's cash flows AND the

discount rate?

- A. Taxation rates

- B. Inflation rates

- C. Depreciation rates

- D. Changes in working capital

- E. The project's terminal value

Answer:

A, B

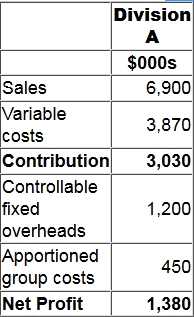

Question 14

Division A is an investment centre with assets of $7.3 million. The following is an extract from the

annual budget for division A:

The cost of capital is 14%.

Calculate the residual income for division A.

- A. $808,000

- B. $1,727,800

- C. $358,000

- D. $2,008,000

Answer:

A

Question 15

One aspect of life cycle costing is the recognition of the fact that during the design or development

stage a large proportion of many products' life cycle costs are:

- A. determined

- B. wasted

- C. under absorbed

- D. amortised

Answer:

A