cima cimapra19 f02 1 practice test

F2 Advanced Financial Reporting

Question 1

Which THREE of the following would typically indicate a finance lease?

- A. An asset with a useful life of ten years is being leased for ten years.

- B. The lessor is responsible for the annual maintenance of the asset.

- C. The lessee has the option to buy the asset at the end of the lease for $1.

- D. The lease contract for an asset includes an upgrade to the asset every two years.

- E. A leased asset has been specifically modified for the lessee's use.

Answer:

A, C, E

Question 2

LM is a car dealer that is supplied inventory by car manufacturer SQ. Trading between LM and SQ is

subject to a contractual agreement. This agreement states the following:

• Legal title of the cars remains with SQ until they are sold by LM to a third party.

• Upon notification of sale to a third party by LM, SQ raises an invoice at the price agreed at the

original date of delivery to LM.

• LM has the right to return any car at any time without incurring a penalty.

• LM is responsible for insuring all of the cars on its property.

When considering how these cars should be accounted for, which THREE of the following statements

are true?

- A. The most significant risks attached to the cars are held by LM.

- B. The most significant risks attached to the cars are held by SQ.

- C. SQ should recognise the cars as inventory in their financial statements.

- D. LM should recognise the cars as inventory in their financial statements.

- E. SQ should recognise revenue when the cars are delivered to LM.

- F. When LM sells a car to a third party, SQ should recognise the revenue associated with that sale.

Answer:

B, C, F

Question 3

In the year ended 31 December 20X7, FG leased a piece of machinery. The accountant of FG had

prepared the financial statements for the year to 31 December 20X7 on the basis of the lease being

an operating lease.

However, following the end of year audit it has been agreed that the machinery is in fact held under

a finance lease and therefore the financial statements need to be corrected.

The correction will have which THREE of the following affects on the financial statements?

- A. Non-current assets will increase.

- B. Finance costs will increase.

- C. Current liabilities will increase.

- D. Non-current liabilities will decrease.

- E. Depreciation costs will decrease.

- F. Non-current assets will decrease.

Answer:

A, B, C

Question 4

On 1 September 20X3, GH purchased 200,000 $1 equity shares in QR for $1.20 each and classified

this investment as held for trading.

GH paid a 1% transaction fee to its broker on this transaction. QR's equity shares had a fair value of

$1.35 each on 31 December 20X3.

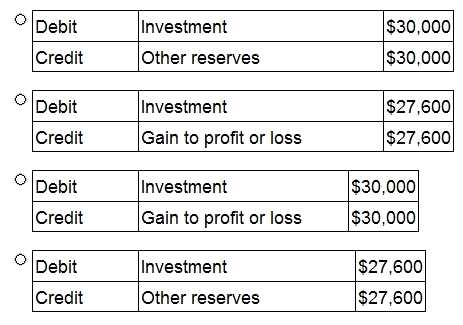

Which of the following journals records the subsequent measurement of this financial instrument at

31 December 20X3?

- A. Option A

- B. Option B

- C. Option C

- D. Option D

Answer:

A

Question 5

Which of the following defines the calculation of interest cover?

- A. Profit before interest and tax divided by finance costs

- B. Finance costs divided by profit before interest and tax

- C. Profit after tax divided by finance costs

- D. Finance costs divided by profit after tax

Answer:

A

Question 6

CORRECT TEXT

In recent years EBITDA has been adopted by large entities as a key measure of performance.

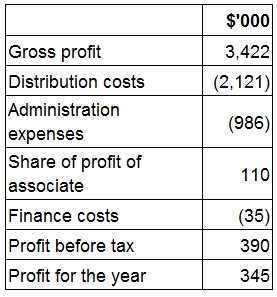

The following figures have been extracted from the financial statements of UV for the year ended 30

November 20X9:

What is EBITDA for UV for the year ended 30 November 20X9?

Give your answer to the nearest $'000.

$ ? 000

Answer:

61500,

61500000

Question 7

Which of the following is NOT an example of an unconsolidated structured entity as defined in IFRS12

Disclosure of Interests in Other Entities?

- A. A post-employment benefit plan

- B. A securitisation vehicle

- C. An asset-backed financing scheme

- D. An investment fund

Answer:

A

Question 8

Which THREE of the following statements about preference shares are true?

- A. For an investor, preference shares carry more risk than ordinary shares.

- B. Unlike ordinary shares, preference shares may be cumulative.

- C. The characteristics of preference shares are closer to debt than equity.

- D. Preference shares cannot be issued as redeemable shares.

- E. Preference shareholders receive their dividend entitlement before the equity shareholders.

- F. Preference shareholders rank below the equity shareholders in a winding up.

Answer:

B, C, E

Question 9

CORRECT TEXT

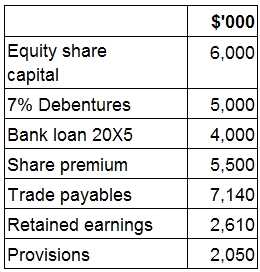

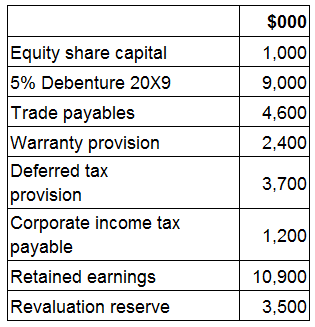

The following is extracted from MN's statement of financial position at 30 September 20X1.

Calculate the gearing (measured as debt:equity) ratio of MN at 30 September 20X1.

Give your answer to one decimal place.

%

Answer:

63.8, 63.78,

63.7, 63.80

Question 10

Which TWO of the following statements about bonds and their issue are true?

- A. Credit rating agencies assign risk categories to bond issues.

- B. Bonds are a form of loan capital, traded on stock exchanges.

- C. Bonds are a risk-free form of investing because they will always be repaid.

- D. All bonds have the same terms and conditions when issued.

- E. A bond issue is never underwritten because the return is fixed and guaranteed.

Answer:

A, B

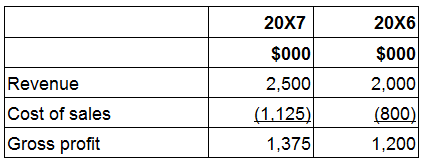

Question 11

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of

static revenues and margins, in August 20X6 KL opened a fourth store at a busy airport terminal

which is proving to be successful.

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of

KL?

- A. A worldwide shortage of leather resulting in increased prices from suppliers.

- B. The opportunity to sell handbags in the airport store at a premium price.

- C. KL locating a new supplier prepared to supply handbags at a cheaper price.

- D. KL locating a new supplier closer to the warehouse, reducing distribution costs.

Answer:

A

Question 12

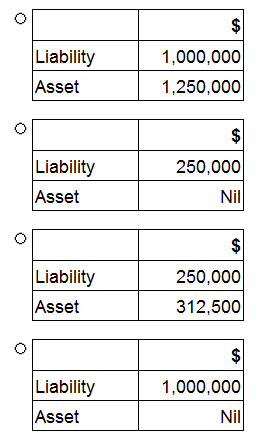

The following information relates to DEF for the year ended 31 December 20X7:

• Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of

$2,500,000.

• There are unused tax losses to carry forward of $1,250,000. These tax losses have arisen due to

poor trading conditions which are not expected to improve in the foreseeable future.

• The corporate income tax rate is 25%.

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31

December 20X7 would recognise deferred tax balances of:

- A. Option A

- B. Option B

- C. Option C

- D. Option D

Answer:

A

Question 13

At 31 October 20X1 RS has in issue 10% debentures 20X8 with a carrying value of $350,000.

Extracts from its statement of profit or loss for the year ending 31 October 20X7 are as follows:

What is the interest cover for RS for the ended 31 October 20X7?

- A. 9.0 times

- B. 11.1 times

- C. 10.0 times

- D. 8.0 times

Answer:

A

Question 14

CORRECT TEXT

Information extracted from JK's statement of financial position for the year ended 31 May 20X5 is as

follows:

Calculate the gearing ratio (Debt/Equity measured as a percentage) at 31 May 20X5.

Give your answer to one decimal place.

? %

Answer:

58.4, 58,

58.44, 59, 58.5, 58.0

Question 15

EFG is preparing its financial statements to 31 March 20X8. During the year ended 31 March 20X7,

EFG purchased a piece of land for $1 million which is used as the staff car park. EFG has a policy of

revaluing land, in accordance with International Accounting Standards, and at 31 March 20X8,

accounted for a substantial increase in its value.

Revenue and operating profit has remained constant over the 2 years.

When comparing EFG's financial statements for the year ended 31 March 20X7 with those of 20X8,

which THREE of the following would be expected?

- A. Increase in profit before tax.

- B. Increase in other comprehensive income.

- C. Increase in return on capital employed.

- D. Decrease in return on capital employed.

- E. Increase in net asset turnover.

- F. Decrease in net asset turnover.

Answer:

B, D, F